Sunresin (SZ300487,CHINA) 2020 and 2021Q1 Result Summary

Stock code: 300487 Stock abbreviation: Sunresin Technology

Bond Code: 123027 Bond Abbreviation: Sunresin Convertible Bond

The following information represents a summary from the company's 2020 annual report and 2021 Q1 quarterly report. The official public information disclosed in Chinese is in accordance with the rules and regulations of the Shenzhen Stock Exchange of China. If there is any discrepancy in translation, the original Chinese version prevails.

During the reporting period of 2020, the company achieved operating income of RMB 923 million reflecting three concurring effects.

1. The pandemic crisis of 2020 impacted economies globally. The shut-downs of Q1 2020 alone led to a decrease of Sunresin‘s revenue in that period by RMB 116 million.

2. The realization cycle of our very large Lithium purification Jintai and Zangge projects which were completed on schedule early 2020 led to a decreased contribution of these projects to revenue of RMB 202 million versus 2019. The successful completion of these projects based on the industrialization of breakthrough innovations serves as major references for our further market development.

3. The growth of the Adsorption materials Sales allowed the company to reduce the impact of the two factors mentioned above.

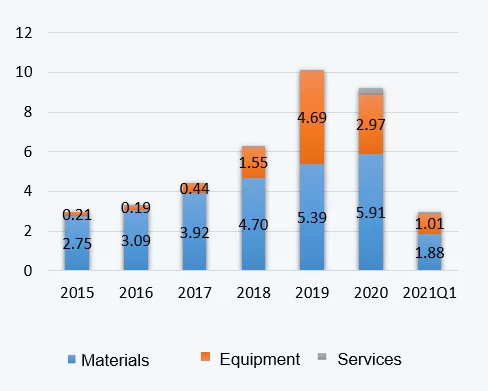

Revenue from main activities(100m RMB, 6.42RMB=1USD)

As an innovation-driven high-tech company, Sunresin’s innovative application areas for materials as well as its innovative business model have accelerated growth. In 2020, sales of adsorption materials have hit RMB 591 million, with a YoY increase of 9.6%. Over the past three years, our MES (Material-Equipment-Services) business model proved to be sought for by customers allowing the company to sustainably benefit from significant contributions from system equipment sales and differentiating Sunresin from competitors as being a “one-stop shop” in the adsorption and separation sector.

Gross profit (100m RMB) and gross margin %

During the reporting period of 2020, the company’s gross profit rate was 47%. The gross profit rate of adsorption and separation materials and that of system equipment were respectively 46% and 47%. Over the years, the company's gross profit margin has been stable at a high level, confirming that the company's strategic direction with production capacity increase and implementation of large-scale projects are reasonable. The high gross profit margins achieved also underline the high added value and high technical barriers to entry characterizing the company's products.

During the reporting period of 2021Q1, the company’s business rebounded strongly with an operating income of RMB 293 million increasing of 126.25% YoY. The net profit attributable to shareholders with RMB 87,3 million increased of 229.46% YoY. The net cash flow from operating activities reached RMB 53.3 million, a net increase of close to RBM 70 million. After turning positive in 2020, the net cash flow continued in positive territory in 2021Q1.

Annex: Key Accounting Data and Financial Indicators

(Currency: Chinese RMB, 1 USD = 6.42 RMB, as of May 11, 2021)

| 2021 Q1 | 2021-2020 Q1+- | 2020 | 2019 | 2020-2019 YoY +/- | 2018 | |

|---|---|---|---|---|---|---|

| Operating revenue | 293,167,908.66 | 126.25% | 922,630,930.07 | 1,011,930,329.55 | -8.82% | 631,986,783.73 |

| Net profit attributable to shareholders | 87,311,765.08 | 229.46% | 202,054,919.34 | 251,290,892.32 | -19.59% | 143,233,818.35 |

| Net cash flows from operating activities | 53,344,392.50 | 426.75% | 260,427,752.05 | -46,995,979.79 | 654.15% | 19,622,371.65 |

| Weighted average ROE | 5.28% | 3.27% | 14.86% | 22.75% | -7.89% | 16.29% |

Sunresin New Materials Co., Ltd.

May 11, 2021